There is an Opportunity Zone in Dickson County.

Taxes & Incentives

Dickson County and the State of Tennessee have numerous tax benefits and incentive programs to make doing business within our borders a can’t-miss proposition. Indeed, Tennessee has been named the state with the 2nd lowest tax burden in the U.S. by WalletHub.com. From workforce investment incentives to a federally designated Opportunity Zone right in Dickson County, the prospects of developing a commercial enterprise are too good to pass up.

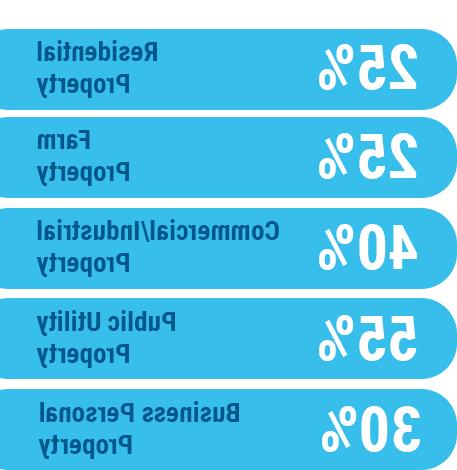

Property Taxes

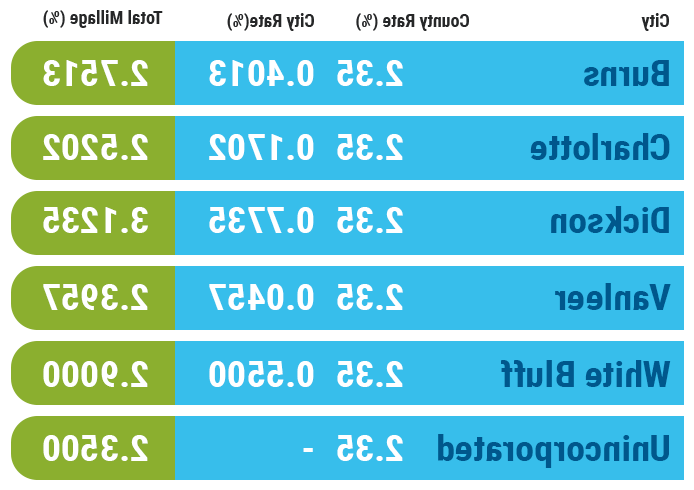

Dickson County, Tennessee has fair taxes, which make the county an equitable place for businesses and employees to thrive. Every assessed property is subject to the 2.35 millage rate for the county, while additional millage rates apply to properties within the confines of the six incorporated municipalities within the county. Property assessment ratios vary by property type. A portion of county property taxes are directed to fund public K-12 education in Dickson County.

Dickson County Property Tax Rates (2022)

Sales Tax

A local sales tax of 2.75% on goods sold in the county helps provide funding for infrastructure and other improvements to the community. State sales tax applies in two ways: a 4% tax on food and food ingredients and a 7% tax on all other personal property unless specifically exempted. In Fiscal Year 2022, local and state sales taxes generated $2,376,868 in Dickson County.

Income Tax

Tennessee does not apply a state income tax on wages, which is an excellent selling point for attracting talented employees. There is officially 0% state tax on interest from bonds, notes and dividends from stock. A state excise tax is assessed at 6.5% of Tennessee taxable income. A franchise tax applies at 0.25% on the greater of net worth or real and tangible property in Tennessee with a minimum tax of $100. Unemployment insurance tax is 2.7% of the first $7,000 with some variation based on occupation.

Local Incentives

Local incentives are determined on a case-by-case basis, with job creation, capital investment and wages as the main factors for consideration. Through a 7-year pilot agreement, the County and EDA can issue abatements on real and personal property with no additional approval necessary, which reduces red tape and promotes business development.

Business Incentives

Dickson County and the State of Tennessee are loaded with tax abatements, grants and incentives for businesses.

Dickson Opportunity Zone

One of the most notable and enticing incentives is the Qualified Opportunity Zone that exists in the south end of Dickson County as designated by the U.S. Department of Treasury. Opportunity Zones were established as part of the Tax Cuts and Jobs Act of 2017 as an economic development tool to spur investment in designated areas. Essentially, companies that develop inside the Opportunity Zone can receive a deferment on their capital gains tax for 10 years.

State Incentives

Tennessee understands how vital business development and job creation is to the state’s economy. As such, a wide array of grants, job credits and tax exemptions serve as distinct features to attract crucial business enterprises to the state.

Grants to eligible entities can be designated for infrastructure, job training and economic development. Numerous job tax credits are available for corporations of varying sizes. A standard job tax credit is available to taxpayers who invest in Tennessee and create jobs as a result of the investment. Taxpayers who meet the requirements of a qualified business enterprise, make the required capital investment of at least $500,000 within three years, and create a minimum number of qualified jobs from the investment may receive a job tax credit equal to $4,500 for each qualified job. The minimum number of qualified jobs that must be created from the investment in a Tier 1 enhancement county like Dickson is 25 jobs.

The generous industrial machinery tax credit allows businesses a credit of 1% to 10% for the purchase, third-party installation and repair of qualified industrial machinery. Sales and use tax exemptions apply to manufacturing locations, warehouses and distributors, call centers and data centers, as well as research and development sites. Qualified headquarter facilities are eligible for additional sales and use tax credits.

TVA Incentives

Numerous incentives offered by the Tennessee Valley Authority include: investment credits that can reduce monthly power bills, performance grants and loans for business improvements and projects, and security deposit coverage that provides electric utility deposit waivers for qualifying customers.